|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

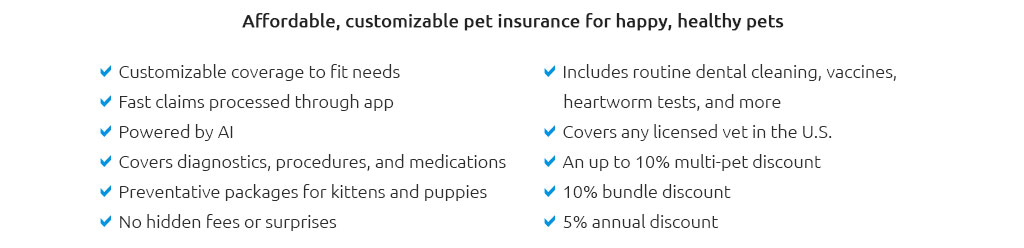

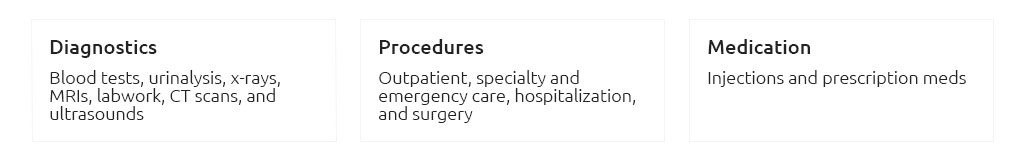

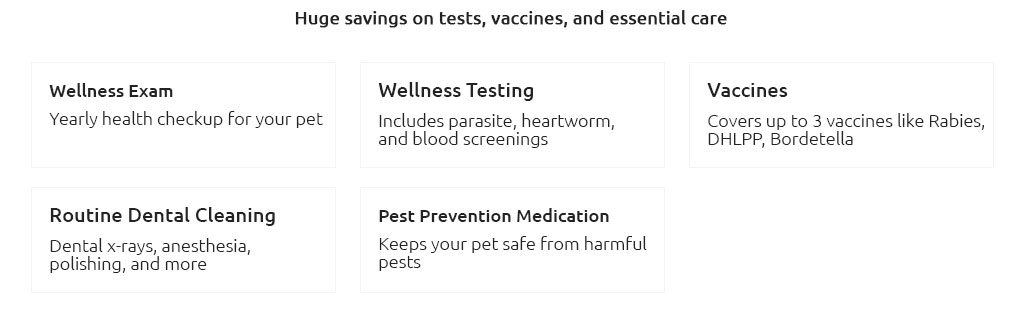

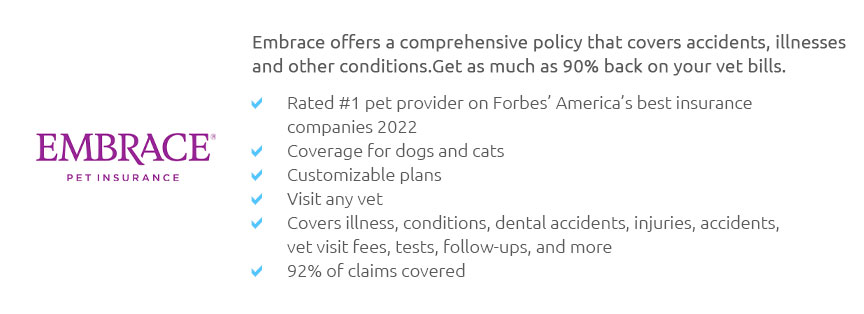

Insurance for Cats and Dogs: What Every Pet Owner Should KnowWhen it comes to ensuring the well-being of our beloved pets, insurance for cats and dogs often emerges as a crucial consideration. These furry companions, who fill our lives with joy and companionship, deserve the best care, and sometimes that includes having a financial safety net in place. Pet insurance can be a lifeline during unexpected medical emergencies, yet many pet owners find themselves puzzled by the nuances of selecting the right policy. In this exploration, we'll delve into the common mistakes to avoid and what you should anticipate when venturing into the realm of pet insurance. Understanding the Basics First and foremost, it is essential to comprehend what pet insurance entails. Simply put, pet insurance is a health care policy that covers certain medical expenses for your pets. Policies can vary significantly, covering anything from accidents and illnesses to routine check-ups and vaccinations. This diversity can be both an advantage and a source of confusion for pet owners. When embarking on this journey, it's vital to align your expectations with what is realistically covered. Many make the error of assuming all-encompassing coverage, only to be surprised when certain treatments or procedures are excluded. Common Mistakes to Avoid

What to Expect When you decide to secure insurance for your pet, anticipate an initial waiting period before coverage begins. This period is designed to prevent fraudulent claims for pre-existing conditions. Additionally, expect to provide thorough documentation of your pet's medical history when filing a claim. This process can be cumbersome, but it ensures transparency and fairness in claim evaluations. Keep in mind that premiums may increase as your pet ages or as veterinary costs rise, a factor that often surprises pet owners unprepared for such fluctuations. In Conclusion Navigating the world of insurance for cats and dogs requires a balance of diligence and foresight. By avoiding common pitfalls and setting realistic expectations, you can secure a policy that offers peace of mind and safeguards your pet's health. After all, our furry friends count on us to protect them just as they protect us with their unwavering love and loyalty. Frequently Asked QuestionsWhat does pet insurance typically cover? Pet insurance commonly covers accidents, illnesses, surgeries, and sometimes routine care. However, coverage varies by policy, so it's crucial to review the specifics carefully. Are pre-existing conditions covered? Generally, pre-existing conditions are not covered by pet insurance policies. It's important to enroll your pet while they are young and healthy to maximize coverage options. Can I use any veterinarian with pet insurance? Most pet insurance policies allow you to use any licensed veterinarian, giving you the flexibility to choose your preferred provider. How are claims processed? Claims are typically processed by submitting a detailed invoice from your vet along with a completed claim form. The insurance company then reviews the claim to determine reimbursement eligibility. https://www.statefarm.com/insurance/pet

Trupanion strives to provide you and your furry family members with the most extensive coverage available from any pet insurance company. https://www.healthypawspetinsurance.com/

The top-rated cat insurance & dog insurance plans cover accidents, illnesses, cancer, emergency care, genetic and hereditary conditions, breed-specific ... https://www.lemonade.com/pet

America's top-rated insurance, now for cats and dogs. Lemonade has earned 4.9 stars in the App store, and is also top-rated by Supermoney, Clearsurance, and ...

|